The United Arab Emirates (hereinafter “UAE”) has been a subject of discussion lately due to their quick and significant changes in the taxation system. The UAE, unlike most other governments, does not rely on taxes to meet its requirements due to its historical richness and stable economic streams.

The UAE was acknowledged as a tax-free Tax Haven State till 2017. Subsequently, the transition started with the introduction of the Excise Tax in 2017 and Value Added Tax or (hereinafter “VAT”) in 2018. The country, then, implemented Economic Substance Reporting (ESR) and Country-by-Country Reporting (CbCR) in 2019. The year 2023 marked a significant development with the introduction of Corporate Tax or (hereinafter “CT”).

The imposition of taxes in a business-friendly jurisdiction such as the UAE may come as a surprise, however, this needs to be viewed in light of the implementation of extensive tax reforms on a global level. The Organization for Economic Cooperation and Development (OECD) Pillar One and Two Projects are the result of pressure from the G7 and G20 for nations to abandon low- or no-tax regimes.

The UAE is a federal country consisting of seven Emirates:

- Sharjah

- Ajman

- Umm Al-Quwain

- Fujairah

- Ras Al Khaimah

- Abu Dhabi

- Dubai

Each Emirate has its own government and tax system, but there is also a federal tax system that applies across the UAE that is administered by the Federal Tax Authority or (hereinafter “FTA”).

The UAE, true to its reputation as a global tax haven, has:

- No Income Tax on Employees, freelancers, and self-employed people of the UAE.

- No Inheritance Tax

- No Social Security Tax on non Gulf Cooperation Council (hereinafter “GCC”) nationals

- No Capital Gain Tax unless a company is taxable under another income tax

- No Estate or Gift Tax

- No Wealth Tax

- No Luxury Tax

- No Taxes on Foreign Pensions

- No Stamp Duty on property purchases or sales

Despite being a tax haven, the UAE has several taxes that businesses should be aware of:

Federal Taxes

- Excise Tax

- Value Added Tax (VAT)

- Economic Substance Reporting

- Country-by-Country Reporting

- Custom Duty

Regional Taxes

(Major Regional Taxes Applicable in UAE)

- Property Transfer Tax

- Municipality (Rental) Tax

- Taxes in Tourist Facilities

- Social Security Levy

Federal Taxes in UAE

Excise Tax

In 2017, the UAE imposed the excise tax. Excise tax is a type of indirect tax applied on specified goods that are often damaging to human health or the environment. These goods are known as “Excise Goods”.

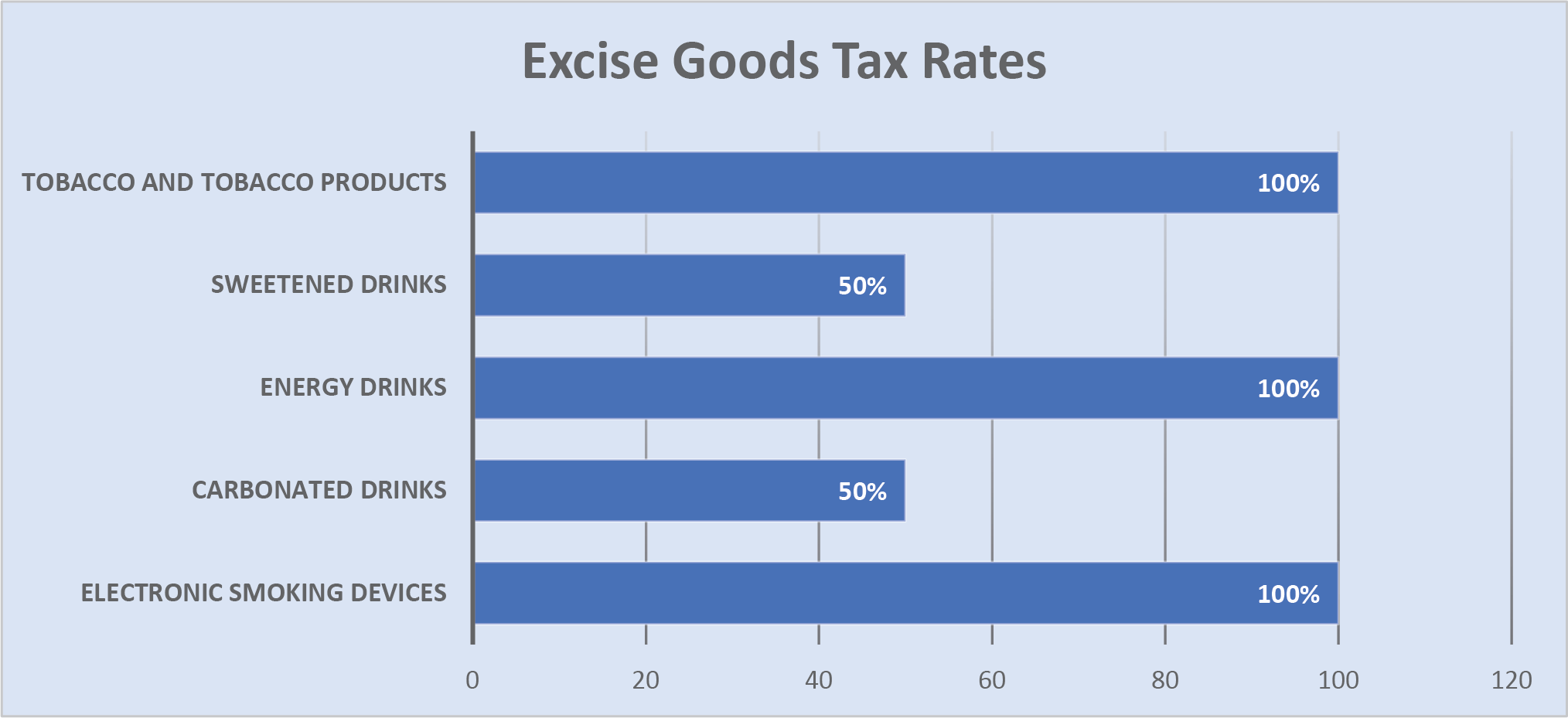

The following tax rates would be applicable on Excise Goods:

Purpose Behind Levying Excise Tax

The UAE government is levying an excise tax in order to curb consumption of unhealthy and harmful goods while simultaneously increasing government income that can be spent on useful public services.

How will it affect consumers?

Consumers will have to pay a higher price for goods that are harmful to human health or the environment.

Registration Criteria Under Exise Tax

- Person who import excise goods into the UAE

- Person who are responsible for overseeing an excise warehouse or designated zone

- Businesses which stockpile excise goods in the UAE in certain cases

- Businesses engaged in the production of excise goods where they are released for consumption in the UAE

Value Added Tax

Since January 2018, a 5% VAT is levied on the majority of goods and services in the UAE, at the point of sale.

The revenue generated by the VAT is used to support government public services. The UAE government also intends for the VAT to lessen the country’s reliance on oil and other hydrocarbons as a source of revenue.

VAT Registration for a Business

- Taxable supplies and imports of a UAE-based business exceed AED 375000 per annum

- Non-UAE based business makes taxable supplies in the UAE, regardless of its value, and there is no other person obligated to pay the due tax on these supplies in the UAE.

- Meanwhile, VAT is optional for businesses whose supplies and imports exceed AED 187500 per annum.

VAT Applicability in Free Zone:

The VAT applies to all tax-registered firms in the UAE, including the Free Zones. However, if the UAE Cabinet designates a certain Free Zone as a “Designated Zone,” it must be taxed as being outside the UAE. The transfer of goods between designated zones is tax-free.

Corporate Tax

Corporate Tax is a form of direct tax levied on the net income or profit of corporations and other entities from their business.

In January 2022, the UAE Ministry of Finance announced that it will impose federal CT on the net profits of businesses. Only oil companies and international banks were subject to corporate taxes in the past. On 9 December 2022, the FTA released the final version of the CT law through Federal Decree Law No. 47 of 2022.

The CT will take effect depending on the Fiscal year followed by the businesses.

Any business that adopts a fiscal year starting on June 1, 2023, and ending May 31, 2024, will be subject to CT starting June 1, 2023. The first tax return filing is likely to be due towards the end of 2024.

Any business that adopts a calendar year starting January 1, 2023, and ending December 31, 2023, will be subject to CT starting January 1, 2024 and filing is likely to be due towards mid-2025.

Entities Subject to Corporate Tax:

- All Businesses: conducting business activities under a commercial licence in the UAE

- Free Zone Businesses unless such businesses or their branches fulfil certain conditions and continue to benefit from 0% corporate taxation on income from qualifying activities and transactions

- Foreign Entities only if they conduct a trade or business in the UAE in an ongoing or regular manner

- Banking Operations

- Businesses engaged in real estate management, construction, development, agency and brokerage activities.

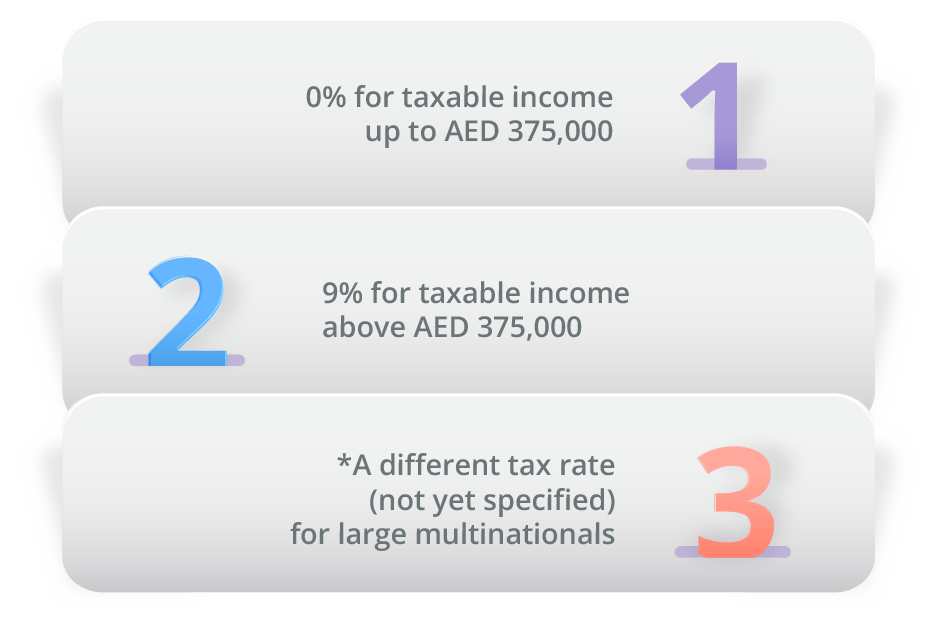

CORPORATE TAX RATES

*Large Multinationals that meet specific criteria set with reference to ‘Pillar two’ of the OECD Base Erosion and Profit Shifting Project will be subject to a varied tax rate.

Entities Exempt from Corporate Tax:

- Business engaged in the extraction of natural resources are exempt from CT as this business will remain subject to the current Emirate level corporate taxation.

- Dividends and capital gains earned by a UAE business from its qualifying shareholdings will be exempt from CT.

- Qualifying intra-group transactions and reorganizations will not be subject to CT, provided the necessary conditions are met.

Double Taxation

The UAE has 142 agreements in place with other countries to minimise double taxation on foreign investments. The agreements on Double Taxation Avoidance are intended to:

- Promote the country’s development goals and diversify its sources of national income

- Eliminate double taxation as well as additional, indirect taxes and tax evasion

- Eliminate any obstacles related to cross-border trade and investment flows

- Provide protection to taxpayers from double taxation, whether direct or indirect

- Promote free interchange of products and services as well as the free movement of capital.

Economic Substance Reporting

In April 2019, the UAE announces economic substance regulations which were repealed in August 2020, Cabinet Resolution No.57 of 2020, which imposed a requirement for UAE entities to maintain an adequate “Economic Presence” in the UAE relative to the activities they undertake.

The UAE economic substance requirements apply to all UAE onshore and free zone companies and certain other business that engage in one or more “Relevant Activity” for fiscal years commencing on or after 1 January 2019.

What are the Relevant Activities?

- Banking activities

- Insurance activities

- Fund management activities

- Financing or leasing activities

- Headquarter activities

- Shipping activities

- Holding companies

- Intellectual property holding or exploitation

- Distribution of goods purchased from foreign connected persons

- Provision of services to foreign connected persons

Entities that meet the requirements to be considered as “Exempt” do not need to demonstrate economic presence in the UAE. However, such entities must file a Notification and provide sufficient evidence to support their exempt status.

Country-by-Country Reporting (CbCR)

Country-by-Country Reporting requirements are applicable to the UAE-based that are part of a multinational group consisting of two or more enterprises that are tax residents in different jurisdictions and have consolidated revenues equal to or greater than UAE Dirhams 3,150,000,000 in the preceding fiscal year starting on or after January 1, 2019.

CbC Report should provide a breakdown of the Multinational Group’s global revenue, profit before tax, income tax accrued, and some other economic activity indicators for each jurisdiction in which the MNE operates.

The purpose of CbC Reporting is to eliminate any information gap between taxpayers and tax administrations with regard to information on where the economic value is generated within the MNE Group and whether it matches where profits are allocated and taxes are paid on a global level.

UAE Customs Duty

Customs Duty on most commodities are determined at 5% of the Cost, Insurance and Freight (CIF) value. Some categories are exempted. Most notably, alcohol is subject to a 50% tariff, while tobacco items are subject to a 100% duty.

Regional Taxes (Major Regional Taxes Applicable in UAE)

Property Transfer Tax

Property transfer tax applies when a property is bought or sold in the UAE. This varies according to the specific Emirate, for example 4% in Dubai while Abu Dhabi charges only 2%. The transfer fee is usually divided equally between the buyer and the seller.

Taxes in Tourist Facilities:

Restaurants, hotels, hotel apartments, resorts etc. in the UAE might charge one or more of the following taxes, which vary per *Emirate.

10% Tax on Room Rate 10% Service Charge 10% Municipality Fees City Tax (Ranging from 6-10%) 6% Tourism Fee

*In Dubai, hotels charge ‘Tourism Dirham Fee’ per room per night of occupancy (for a maximum of 30 consecutive nights) ranging from AED 7 to 20 depending on the category or grade of the hotel.

*Abu Dhabi would charge a new additional fee of 4 percent of hotel stay bill and AED 15 charges per night per room.

*Abu Dhabi would charge a new additional fee of 4 percent of hotel stay bill and AED 15 charges per night per room.

Municipality (Rental) Tax:

Taxes on rented properties vary between the Emirates.

In Dubai, residential tenants pay 5% of their annual rent in rental tax, while 10% is added onto commercial tenants.

However, in Abu Dhabi, UAE citizens are not taxed on their properties, but their expat counterparts pay 5%.

In Sharjah, all tenants pay a rental tax of 2%.

The municipality tax is calculated as 5% of your rental contract’s value for all premises, with a minimum amount to pay of AED 450 per annum. Although the total fee applies from the first day of the rental contract, the annual fees are broken down into monthly instalment to make payments easier.

Social Security Levy:

Social security contributions for UAE national employees, are calculated at a rate of 20% of the employee’s gross remuneration as stated in the local employment contract.

Out of the 20%, 5% is payable by the employee, 12.5% is payable by the employer, and an additional 2.5% contribution is made by the government. A higher rate of 26% is applied in the Emirate of Abu Dhabi, where the contribution of the employer is increased to 15%, the government’s contribution is increased to 6%, and the employee’s contribution remains 5%.

Employees of enterprises and branches registered in a Free Trade Zone (FTZ) are also subject to social security duties.

Social security contributions for other GCC nationals working in the UAE are determined in accordance with their home country social security legislation.

Returns to be Filed in the UAE

| Type of Tax Returns & Payment | Tax Period* | Deadline |

|---|---|---|

| Excise Tax Return and Payment | Monthly | 15th day of each calendar month |

| VAT Return and Payment | Quarterly: Where annual turnover is below AED 150 million Monthly: Where annual turnover is AED 150 million or more |

Within 28 days of the end of the Tax Period |

| Corporate Tax Return | Annually | Within 9 months from the end of the relevant Tax Period |

| Economic Substance Notification | Half Yearly | Within 6 months of end of financial year |

| Economic Substance Report | Annually | Within 1 year from the end of financial year |

| Notification by Ultimate Parent Entity of MNE Group | Annually | Not later than the last day of the financial reporting year of such MNE |

| Report by Ultimate Parent Entity of MNE Group | Annually | Within 1 year from the end of financial year |

*The FTA may, at its choice, assign a different Tax Period for certain type of businesses.

Failure to Pay and Submit a Tax Return

Failure to submit and pay a tax return within the required time limit can result in a range of fines and penalties, depending on the severity of the violation and the duration of the delay.

In the UAE, some frequent penalties and fines for late submission of tax returns and payment include:

- Late filing fees

- Interest charge

- Administrative penalties

- Prosecution

Conclusion

The UAE is well-known as a tax haven, offering a tax-friendly environment for businesses. However, in order to fuel the country’s economic growth and development, the UAE government has implemented taxes in recent years.

As a result, the UAE will lose its tax-free status, but businesses will benefit from enhanced transparency and recognition of the country as a fully globally compliant jurisdiction with suitable structure.

Source:

Ministry of Finance: https://mof.gov.ae/

Federal Tax Authority: https://u.ae/en/information-and-services/finance-and-investment/taxation/corporate-tax

Taxes, Service Charges and Tipping: https://visitabudhabi.ae/en/plan-your-trip/essential-info/taxes-service-charges-and-tipping

Disclaimer

The information provided in this article is intended for general informational purposes only and should not be construed as legal advice. The content of this article is not intended to create and receipt of it does not constitute any relationship. Readers should not act upon this information without seeking professional legal counsel.