Introduction:

New Company Law of the country along with its implementing regulation has been entered into force on 19 January, 2023, while repealing the Company Law 2015 and Professional Company Law of 2019. This comprehensive legislation introduces significant changes to the business landscape while streamlining the process of company formation, enhancing corporate governance practices, protecting minority shareholders, facilitating foreign investments, and modernizing insolvency procedures. The new law is generally applicable to all entities formed or incorporated on or after January 19, 2023. A two-year grace period has been given to current entities to make any necessary modifications in order to comply with the new law.

Brief idea about New Company Law:

The new version of statute is a single comprehensive law which governs all forms of entities in Saudi market, be it commercial, entities which are operated by families, non-profit or professional. Moreover, seeing the demand from investors for startups, with the introduction of new law, a new flexible form of corporate has also been introduced being named as Simple Joint Stock Company (SJSC). Under New Law the following corporate forms are permitted:s

- Limited Liability Company (LLC)

- Joint Stock Company (JSC)

- Simple Joint Stock Company (SJSC)

- General Partnership

- Limited Partnership

Key differences in comparison with the old Companies Act

| S. No. | Comparison points | Old Companies Act | New Companies Act | Effects of New Companies Act |

|---|---|---|---|---|

| 1 | Introducing new form of Company | ARTICLE 3 No Provision of Simplified joint-stock company |

ARTICLE 4 Simplified joint-stock company introduced by new Act. |

Rapid growth of new startups in the market |

| 2 | Limited liability company shareholder Annual Meeting | ARTICLE 167 Once a year during the four months period following the end of the year |

ARTICLE 165 Once a year during the six-month period following the end of the year |

Ease of working by giving extra time |

| 3 | Dissolution or Continuation of Company due to loss of half of the capital | ARTICLE 181 Manager call for a meeting within ninety days from date of knowledge to consider continuation or discontinuation. |

ARTICLE 182 Manager call for a meeting within sixty days from date of knowledge to consider continuation or discontinuation. |

Reduction of time to call meeting to make practically possible |

| 4 | Unlimited Liability Company | ARTICLE 17 All partners in a company jointly and personally liable for the debts and liabilities of the company. |

There is no provision of unlimited liability under new law. | Improvement of investment environment in state |

| 5 | Board Meetings | ARTICLE 83 It shall be held at least twice a year. |

ARTICLE 80 It shall be held at least four times in a year. |

Supervision of the business operations, risk management and performance regularly |

Newly Added Provisions:

- Simplified Joint-Stock Company (Article 138-155)

The Main change in Saudi Arabia is the introduction of new form of company Simplified Joint-Stock Company to expand growth of the company and making less complicated. It does not require to maintain minimum capital requirement. President, Manager or Board of Directors have all the powers to manage a company to achieve its purpose.

Important points:- All the acts that have been entrusted to Shareholders in Articles of Association or under any special provision of Law must be done by them only.

- President, Manager or Board of Directors shall be bound by theirs acts performed even though beyond the powers unless such person acts in bad faith or knowingly doing the act.

- Simplified Joint-Stock Company neither grant any loan nor provide guarantees to its Board of Directors.

- President, Manager or Board of Directors call upon the Shareholder meetings in some cases Auditor or Shareholder having at least 10% voting shares can also call meeting.

- President, Manager or Board of Directors shall present Company’s Financial Statement, auditor’s report, dividend distribution, position and documents of the company to shareholder within six months after the end of fiscal year.

- Single-Person Limited Liability Company (Article 157)

New Act introduces a concept in which a Single person have power to manages all the acts and his decisions shall be recorded in writing in a special register and wholly responsible for it. He can appoint other person to represent the company before authorities. - Micro or Small company (Article 19)

Small company during registration of company in the first year or for two consecutive years. These companies do not require to appoint auditor. - Joint Venture Agreements and Family charter (Article 11)

Agreements with the company’s shareholder and their heirs to regulate relationship with each other and family charter that includes governance, dispositions and policy of employment. It shall be binding until it agrees to the law or Article of the company to regulate family business ownership, management, and employment practices. - Limited liability company (Article 156-184)

Limited liability companies are formed by one or more natural or legal persons. Company is solely liable for his liabilities occurs due to the activities in the company. They can issue negotiable debt instruments to enhance financial capabilities and widened capital market law. - Joint-stock company (Article 58-137)

Incorporation license may be issued by the Ministry of Commerce and Industry under the New Law. Company can be incorporated by one or more persons there is no minimum requirement of partners in the company. It permits the issue of different classes of shares, each having unique rights and liabilities also removing the board members compensation ceiling’s upper limit.

Major Compliances Under Company Law

- Incorporation of Company (Article 4, 5): In order to establish a company, it must be incorporated in any of the earlier mentioned forms and must have registered trade name in Arabic or any other language.

- Annual Preparation and Filing of Records and Financial Statements (Article 17): The Companies operating in Saudi Arabia are required to prepare records and financial statements by the end of each fiscal year, on or before March 31st, in accordance with the approved standards of country. The prepared statements and auditor’s report shall be filed by the Manager or chairman of the board of directors of the company with Saudi Business Center within six months from the date on which the fiscal year ends, which is on or before September 30th of every year.

- Appointment of Licensed Auditor (Article 18): Appointment of one or more Licensed Auditor is one of the other major obligations on the part of companies operating in Saudi Arabia. Auditor must be authorized to practice in country and things related to his tenure, appointment, fees, scope of work shall be determined by partner or general assembly of the company.

- Annual General Assembly (Article 165): The LLCs are required to convene general meeting comprising of all of its partners at least once a year during the six-month period following the end of the company’s fiscal year, where an invitation must be sent to all partners at least 21 days prior to the date for the said meeting.

- Display of Details Related to Company (Article 237): In all of its paperwork, documents, and publications, a foreign company’s branch or representative office must provide its address within the Kingdom in addition to the company’s complete name, address, and headquarters.

Conclusion:

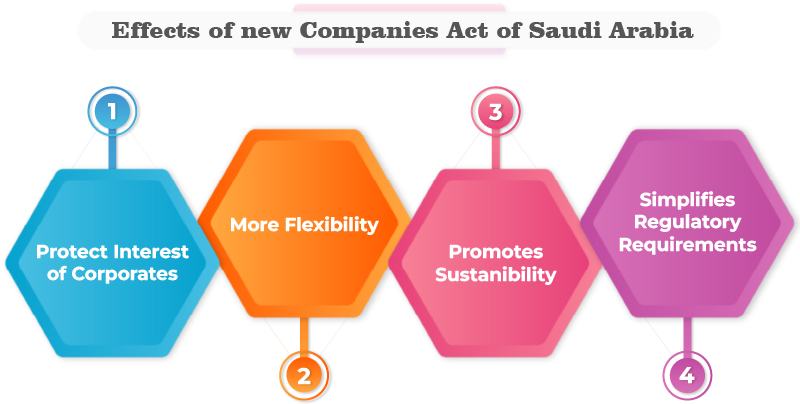

Change is a step-forward in simplifying the management of companies and encouraging investment. The SJSC and joint stock companies can hold general meetings using current technology. The Companies Law of 2015 and the Professional Companies Law of 2019 will be repealed to simplifies the regulatory requirements and grants more freedom in drafting and laying out the bylaws or articles of association. It protects shareholders and reduces the conflicts in Saudi Arabia’s corporate sector. It establishes regulations regarding the conversion, merger and division of corporations and the new regulations offer greater clarity than the regulations under the Old Law regarding the rights and obligations of interested parties during a corporation’s conversion, merger or dissolution.

Disclaimer

The information provided in this article is intended for general informational purposes only and should not be construed as legal advice. The content of this article is not intended to create and receipt of it does not constitute any relationship. Readers should not act upon this information without seeking professional legal counsel.