The Union Budget 2025-26, presented by Finance Minister Smt. Nirmala Sitharaman, focuses on balanced, inclusive growth under the theme “Sabka Vikas” to ensure development across all regions of India. The budget outlines the principles of a “Viksit Bharat” (Developed India), with goals including zero poverty, quality education, accessible healthcare, skilled labor, greater women participation in economic activities, and making India the global “food basket.”

Direct Tax

Revised Tax Slabs:

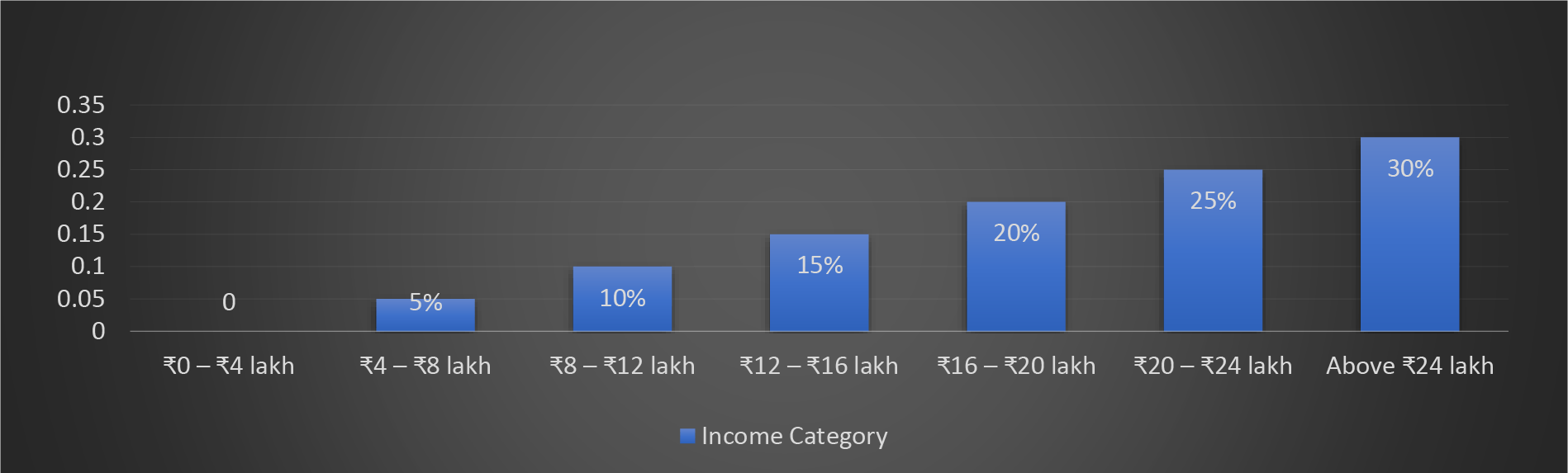

The Union Budget 2025-26 focuses on supporting the middle class by introducing new direct tax slabs that reduce the tax burden. The proposed tax slabs under the New Tax Regime, wherein individuals earning up to Rs. 12 lakhs annually (Rs. 1 lakh per month) will pay no income tax, with a standard deduction of Rs. 75,000 for salaried individuals.

The new tax rates are:

Note:

- Rates under the Old Regime of Tax remain the same.

- For rebate under Section 87A, income limit increased from Rs. 7 Lakhs to Rs. 12 Lakhs.

Relaxation in TDS/ TCS Rates:

| Section | Nature of Income | Current Threshold | Proposed Threshold |

|---|---|---|---|

| 193 | Interest on Securities | Nil | Rs. 10,000 |

| 193 | Interest payable to resident individual/HUF on any debenture issued by public company | Rs. 5,000 | Rs. 10,000 |

| 194 | Dividend | Rs. 5,000 | Rs. 10,000 |

| 194A | Interest other than interest on Securities |

|

|

| 194B | Winning from Lotteries, Crossword Puzzles, gambling, betting, etc. (except online games | Aggregate of amounts exceeding Rs. 10,000 during the financial year | Rs. 10,000 in respect of a single transaction |

| 194BB | Winnings from online games | ||

| 194D | Insurance Commission | Rs. 15,000 | Rs. 20,000 |

| 194G | Commission and other payments on sale of lottery tickets | Rs. 15,000 | Rs. 20,000 |

| 194H | Commission and Brokerage | Rs. 15,000 | Rs. 20,000 |

| 194-I | Rent | Rs. 2,40,000 during the financial year | Rs. 50,000 per month or part of a month |

| 194J | Royalty and Fees for Professional or Technical Services | Rs. 30,000 | Rs. 50,000 |

| 194K | Income in respect of units of mutual fund | Rs. 5,000 | Rs. 10,000 |

| 194LA | Compensation on account of compulsory acquisition of an immovable property | Rs. 2,50,000 | Rs. 5,00,000 |

Other Key Changes:

- Proposal to introduce a new tax code, which is simpler and easier to comprehend.

- Extension of presumptive taxation scheme, for Non-residents engaged in business of providing services or technology for setting up an electronics manufacturing facility or in connection with manufacturing or producing electronic goods, article or thing in India, wherein 25% of the amount received by such Non-resident will be deemed as profits, effective from April 01, 2026

- Extension of time limit for filing updated return from 2 years to 4 years from the end of the relevant assessment year, subject to payment of additional tax as under, effective from April 01, 2025:

| Time Period | Additional Tax Computation |

|---|---|

| Between 2-3 years | 60% of aggregate of Tax and Interest payable |

| Between 3-4 years | 70% of aggregate of Tax and Interest payable |

- Extension of registration period for smaller trusts or institutions, from 5 years to 10 years, effective from April 01, 2025.

- Proposal for removal of Section 206AB and 206CCA, related with higher TDS/ TCS rates for non-filers of income tax returns.

- Rationalization of Bar of Limitation for Imposing penalties, wherein no order imposing a penalty shall be passed after the expiry of 6 months from the end of the quarter in which, existing proceedings are completed or revision/ appeal order is received or penalty imposing notice is received, as the case may be, effective from April 01, 2025.

Indirect Tax

Customs Act:

- Amendment to First Schedule to Custom Tariff Act 1975, to increase rates on certain tariff items and create new tariff lines for products like defence items, technical textiles, sustainable blended aviation fuel, e-bicycles etc.

- 2 year deadline has been established for finalizing provisional assessments with a possible 1 year extension, if justified.

- Removal of 7 customs tariff rates for industrial goods, simplifying tariff structure

- Deadline for utilizing imported inputs has been extended from 6 months to 1 year

Excise Act:

- Implementation of higher excise duty on sale of unblended Diesel

- Powers and functions vested with Settlement Commission for disposing pending applications will now be exercised by Interim Board for Settlement

Central Goods and Services Tax:

- Distribution of Input Tax Credit (ITC) by Input Service Distributors (ISD):

Input Service Distributors (ISD) are now permitted to allocate Input Tax Credit (ITC) on inter-state supplies subject to tax under the Reverse Charge Mechanism (RCM). This amendment provides greater clarity on ITC distribution and aids businesses in efficiently managing their tax liabilities. - Track and Trace Mechanism for Specified Goods:

New track-and-trace mechanism has been introduced for specified goods or categories of persons, incorporating unique identification markings. The Bill also prescribes penalties for non-compliance. This system enhances monitoring, prevents tax evasion, and ensures effective tracking of regulated goods such as pharmaceuticals, alcohol, and other specified items. - Deposit Requirement for Appeals in Certain Cases:

New requirement mandates the deposit of 10% of the penalty amount in cases where a penalty is levied without any associated tax demand. This provision ensures a financial commitment when filing appeals against penalty orders, discouraging frivolous litigation. - Clarification on Tax Treatment of Warehoused Goods in Special Zones:

The Bill retrospectively amends Schedule III of CGST Act, effective from July 1, 2017, to clarify that goods stored in Special Economic Zones (SEZs) or Free Trade Warehousing Zones (FTWZs) and supplied to any person before export clearance or movement to the Domestic Tariff Area (DTA) will not be considered a supply of goods or services. This amendment eliminates ambiguities in tax treatment and aligns with the principle of export-oriented taxation. - Supplementary Amendments to the CGST Act:

Sections 12(4) and 13(4), which governed the time of supply for vouchers, have been removed. As a result, the sale or distribution of vouchers in a peer-to-peer (P2P) model will no longer be subject to GST. This simplifies the taxation of vouchers and eliminates uncertainty in digital and prepaid voucher transactions.

Disclaimer

The information provided in this article is intended for general informational purposes only and should not be construed as legal advice. The content of this article is not intended to create and receipt of it does not constitute any relationship. Readers should not act upon this information without seeking professional legal counsel.