The ban on selected Single-Use Plastic (SUP) items came into effect on July 1, 2022. Is the message right to say that India has banned Single-Use Plastics (SUPs)? Did India completely ban the usage of SUPs? So, you won’t get soft drinks and mineral water bottles anymore in this hot summer? The answer to all these questions is a big ‘NO’, and this article will provide an explanation. This article will discuss the rationale behind such a ban, the position of law at present, including the initiatives taken earlier, the economic impacts on different sectors, the lacunas in the decision in the light of the listed entities, the scope ahead and the future threats.

The True Picture and the Rationale behind Banning

It would be wrong to say that India has wholly banned SUPs. However, it should be noted that the country has made a first attempt to regulate plastic waste management. In toto, 19 SUPs items have been banned, as mentioned below:

- Earbuds with plastic sticks, plastic sticks for balloons, plastic flags, candy sticks, ice cream sticks, polystyrene [Thermocol] for decoration;

- Plates, cups, glasses, cutlery such as forks, spoons, knives, straws, trays, wrapping or packing films around sweet boxes, invitation cards, and cigarette packets, plastic or PVC banners less than 100 microns, stirrers.

The meaning of ‘single-use plastic commodity’ refers to the plastic item which can be used once for the same purpose before its disposal or recycling. The current ban extends to all activities, i.e., import, manufacturing, stocking, distribution, selling, and usage of identified SUPs with low utility and high littering potential.

The rationale:

- The reason behind selecting the items was based on the intricacy of collecting such plastic items and their recycling afterward. The core problem arises when plastic remains in the environment for a long period and does not decay, converted to microplastics thereon. Further, it enters the human body by entering food sources.

- Moreover, due to various international obligations, including the nation’s commitment to cut the carbon emission by 2030 in relation to Paris Agreement.

- Adding to the list, in the financial year 2020, India turned out to be the fifth-highest generator of plastic waste, with a discharge of 3.5 million tons.

- The status of Plastic Waste Management in the country below presents that the States have an insufficient capacity for recycling, however generating in excess:

| S.No. | Item | Quantity | Remark |

|---|---|---|---|

| 1. | Estimated plastic waste generation | 34,69,760 TPA | Based on data provided by 35 states in annual report |

| 2. | Recycling capacity (20 States) | 15.62 Lakhs TPA | Based on data provided by 20 states in O.A. No. 247/2017 |

| 3. | Co-processing | 1.67 Lakhs TPA | Based on data provided by 20 states in O.A No. 247/2017 |

| 4. | Major 3 states generating plastic waste | Maharashtra (13%) Tamil Nadu (12%) & Gujarat (12%) |

Based on data provided by 35 states in annual report |

Source: Annual Report 2020-21 (Central Pollution Control Board) Table 6.8 – Status of Plastic Waste Management in the Country

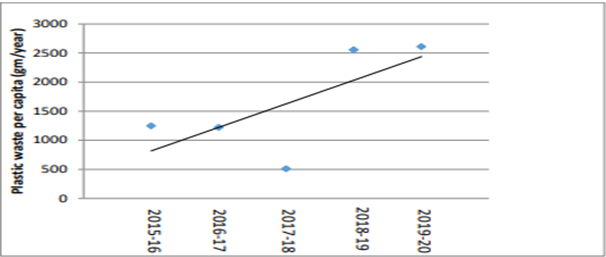

- The per capita plastic waste generation has approximately doubled in 2019-2020 than from 2015-2016.

Source: Annual Report 2019-20 on Implementation of Plastic Waste Management Rules, 201621 (Central Pollution Control Board) Fig.2: Per capita Plastic waste generation 8279/2021/UPC-II-HO

The New Beginning and The Old Monk: Enactment of EPR

The Ministry of Environment, Forest, and Climate Change (MoEFCC), on February 16, 2022, notified the guidelines on External Producer Responsibility (EPR) on plastic packaging through the Plastic Waste Management (Amendment) Rules, 2022. With the rules, the responsibilities have been imposed upon the producer for the treatment and/ or end of the life of plastic packaging waste.

The producers are obligated to treat and dispose of plastic packaging waste through these guidelines. The intention is to prevent plastic waste at the source, promote initiatives for designing environmentally friendly products, and promote public recycling. The key highlights of the EPR Guidelines provide for:

- It classifies plastics into four categories:

| Category I | Rigid Plastic Packaging |

|---|---|

| Category II | Flexible Plastic Packaging of a single layer or multilayer comprising different types of plastic layers. It also covers plastic sheets and covers made from it, plastic pouches, carry bags, and sachets. |

| Category III | Multi-layered plastic packaging where a minimum of one layer of plastic and a minimum of one layer of other material is different from plastic. |

| Category IV | Plastic sheets or similar are used for packaging, and the carry bags are made up of compostable plastics. |

- The responsibility of filing an annual return is imposed upon the producers, importers, and brand owners wherein the details about the plastic packaging waste collected and processed must be included and have to be submitted to Central Pollution Control Board (CPCB) or respective State Pollution Control Board or such Pollution Control Committee as prescribed by June 30 of succeeding financial year.

In addition, the information related to reuse and/or recycled content used for the purpose of packaging shall also be provided. - It includes the provisions of levy of Environment Compensation based upon the Polluter Pays Principle levied to producers, importers, and brand owners on non-fulfillment of EPR targets.

However, the payment of said compensation shall not absolve the said responsibility, and it will be carried forward to the next year for a period of 3 years.

The government had made initiatives for redressal of the environmental issue earlier as well. With effect from September 30, 2021, the import, manufacturing, stocking, selling, distribution, and usage of carrying bags made with virgin or recycled plastics less than 75 microns has already been banned.

In the year 2016, a complete ban was imposed on plastic sachets used for storage, packaging, and selling of tobacco, gutkha, and pan masala.

The lacunas: No significant impact on listed entities

The biggest question that arises is what is the share percentage of SUPs that were banned in the total plastic waste. The answer is quite surprising as not more than 2-3% of the share of SUPs is contributed by the listed entities, as highlighted by the Economic Times in their article published on July 4, 2022.

It is evident that the ban only covers a small fraction of plastic waste production and excludes from its ambit the wrappers of food items, dairy products, and others which contribute in huge proportion to the overall consumption. As usual, the decision will primarily affect the small businesses as, for them, it is not economically feasible to switch to alternatives.

Economic Impact on Different Sectors

Whenever there is an update in plastic waste management, the FMCG sector affects the most, as they are heavily dependent upon plastic packaging wrappers. For instance, the banning of plastic straws will affect the companies like Dabur, Parle Argo, Mother Dairy, and other such manufacturers making and selling fruit juices, dairy products, and other low-value packs of juice/ beverages.

Dabur India highlighted that the cost of using paper straws would rise to Rs1-1.25 per unit from the existing Rs.0.25-0.30 as they need to import the same. It appears a threat for the company as it will not only decrease their profit margins but also increase their dependability because the paper-based straws are to be imported from other countries. However, the import of the same will only be able to meet the demand by 10-15%, and there will be a huge demand-supply gap. At the same time, the risk of passing the cost burden to the ultimate consumer will always be there. Hence, it appears not economically viable to import the same.

The maximum impact will be on manufacturers of polystyrene, which is being used on a wider impact. On the other hand, the cigarette and such tobacco manufacturing would not get affected since they already have been migrated to bio-degradable plastics wraps.

Penalties for using SUPs

The approach of the government appears to be uncompromising and stern. The notification banning SUPs provides for actions as per the Environment Protection Act, 1986. Section 15 of the Act provides for penalties for first-time offenders and repeated offenders wherein such offenders are subject to jail of up to five years, or a penalty of up to Rs 1 lakh, or both and jail of up to seven years respectively. In addition, the penalties including seizure of goods, levying of Environmental Compensation, and closure of operations of Industries/ Commercial Establishments, shall be taken against the violators.

The Initiatives: A Step Ahead

The ban, without providing alternatives, in no case, is a solution, that is the reason the government has taken measures to ensure the alternatives to the existing supplies.

- The CPCB is promoting the manufacturing of compostable plastics, and for the same, the license has already been issued to 200 manufacturers.

- The Government has, considering their initiative of ease-of-doing business policy, fixed this requirement for the single-time certificate, and no renewal is requisite.

- Moreover, the process has been more facilitated by providing an Online portal for seeking the said certificate for such manufacturers.

It has opened up the scope of innovation and will strengthen the R&D in the sector.

Ground Reality of such a ban

It’s been 4 months down since the complete ban came into effect and the ground reality is not surprising. Various media houses have reported the ground reality report wherein they found that such a ban has no serious effect left anymore. The banned SUPs are still in circulation and they can be seen easily at eateries, market place and other public places. Initially, some states actively attempted to enforce the ban by imposing fines on the violators, however, later things are getting back to the old days due to a lack of strict attitude.

Conclusion

The present ban on single-use plastics may not have a more significant impact on listed companies, however, if the ban had been extended to wrappers, pouches, sachets, or such other materials, then it would have seriously affected the FMCG companies operating in the listing space.

The appeal has been made for collaborative efforts for all stakeholders for the effective implementation of the same, and at the same time, the strictness can be witnessed in the approach adopted by the government.

There are sufficient chances of expansion of such prohibition to other items impacting various sectors altogether. Therefore, it is advisable for all entities and stakeholders should reduce their dependability on plastics and move to environmentally friendly substitutes.

Disclaimer

The information provided in this article is intended for general informational purposes only and should not be construed as legal advice. The content of this article is not intended to create and receipt of it does not constitute any relationship. Readers should not act upon this information without seeking professional legal counsel.