Introduction:

The Gig economy in India has been rapidly expanding, driven by technological advancements and changing employment patterns. Gig workers, who typically engage in short-term, flexible jobs, often lack the protections and benefits traditionally associated with full-time employment. The Covid-19 pandemic brought many challenges for gig workers in India. Gig Workers, who mostly rely on short-term jobs like ride-sharing and food delivery, faced sudden loss of income and job security when demand dropped sharply. Without the benefits and protections that regular employees have, many find themselves struggling to make ends meet. This article explores the legal framework and protections applicable to gig workers in India.

WHO ARE GIG WORKERS?

Gig workers are individuals who undertake temporary, flexible jobs, often facilitated by digital platforms. Gig workers are outside the ambit of traditional employer-employee relationships including but not limited to ride-sharing (e.g., Uber, Ola), food delivery (e.g., Zomato, Swiggy), freelance services (e.g., graphic design, content writing,) etc. These workers typically operate as independent contractors rather than full time employees.

Gig workers often appreciate the flexibility and independence that comes with this arrangement, but they also face challenges, such as inconsistent income, lack of job security, and limited access to benefits like health insurance or paid leaves.

LEGAL COVERAGE

Code on Social Security, 2020

Rajasthan Platform Based Gig Workers (Registration and Welfare) Act, 2023

Karnataka Platform-based Gig Workers (Social Security and Welfare) Bill, 2024

The Ministry of Labour and Employment has introduced 4 Labour Codes, out of which Code on Social Security, 2020 (hereinafter referred to as “Code”) has amalgamated 9 Labour laws with an aim to extend social security to all employees and workers of both the organized or unorganized sector. One of the significant changes introduced in this Code is the inclusion of Gig or Platform workers.

As per Section 2(35) of the Code, “Gig Worker” means a person who performs work or participates in a work arrangement and earns from such activities outside of the traditional employer-employee relationship.

This Code empowers the Central Government to launch various social security schemes for such workers on the matters related to: –

The Code also places an obligation on the Central Government to constitute the National Social Security Board for the welfare of the unorganized workers, gig workers and platform workers to recommend and monitor the schemes for such workers.

The Code empowers the government to establish free call helpline centers for gig workers to:

- Provide information about available social security schemes

- Assist with the filing, processing, and submission of registration application forms

- Help in obtaining registration etc.

Apart from the Code on Social Security, 2020, Rajasthan has emerged as one of the first and only states in India to regulate the engagement of gig workers at the state level. On July 24, 2023, the Rajasthan Government passed the Rajasthan Platform Based Gig Workers (Registration and Welfare) Act, 2023, with a goal to provide social security benefits to gig workers.

As per Section 2(e) of the Act, “Gig Worker” means a person who performs work or participates in a work arrangement and earns from such activities outside of the traditional employer-employee relationship and who works on contract that results in a given rate of payment, based on terms and conditions laid down in such contract and includes all piece-rate work.

The Act establishes the Rajasthan Platform-Based Gig Workers Welfare Board, which will:

- Oversee the registration of platform-based gig workers

- Monitor social security schemes for registered workers and provide recommendations to the State Government for their administration

- Ensure that platform-based gig workers can access benefits under the schemes created by the State Government

- Protect the rights of platform-based gig workers

- Facilitate timely resolution of grievances related to their rights, among other responsibilities

The Act also provides for the establishment of a Welfare Fund for the benefit of registered platform-based gig workers consists of sums received from welfare fees, grant-in-aid from the State Government and from other sources.

The Act further provides for the redressal of grievances whereby registered platform-based gig workers have a right to file a petition before an officer, to be designated by the State Government or through web portal with respect to any grievance relating to their entitlements, payments and other benefits provided under the Act.

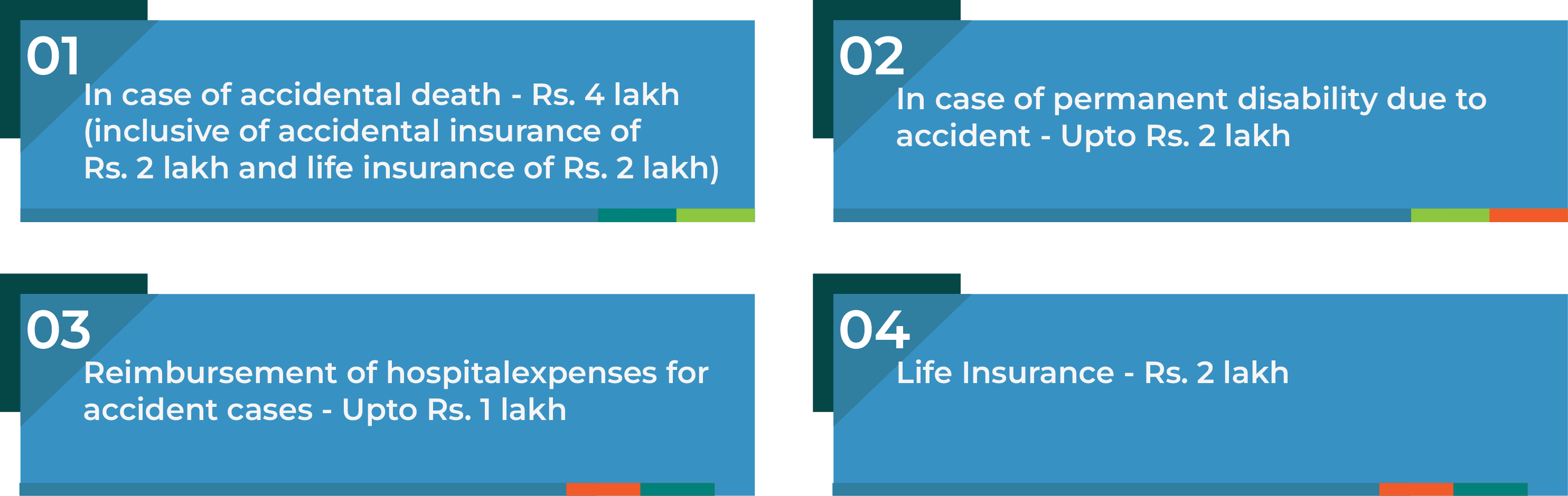

Following Rajasthan, Karnataka Government introduced a draft of Karnataka Platform-based Gig Workers (Social Security and Welfare) Bill, 2024 on June 26, 2024 in order to protect the rights of gig workers by implementing social security benefits. In addition to this, the Government of Karnataka has already introduced the Karnataka State Gig Workers Insurance Scheme. The workers between the age of 18 to 60 years are eligible for registration under this scheme, and they should not be income tax payers as well as the beneficiaries of Employee’s Provident Fund and Employee’s State Insurance. The benefits available in this scheme are as follows: –

CONCLUSION

The gig economy in India stands at a critical juncture, characterized by social security benefits and significant challenges at the same time. While the introduction of Code on Social Security marks a positive shift towards the entitlements of various benefits gig workers deserves. As the gig economy continues to grow, more robust legal frameworks will be essential for safeguarding the interests of this increasingly vital workforce. By acknowledging gig workers as essential contributors rather than mere temporary labourers, lawmakers can create a more equitable framework that not only enhances their well-being but also fosters a sustainable and flexible gig economy for the future.

Disclaimer

The information provided in this article is intended for general informational purposes only and should not be construed as legal advice. The content of this article is not intended to create and receipt of it does not constitute any relationship. Readers should not act upon this information without seeking professional legal counsel.