Introduction

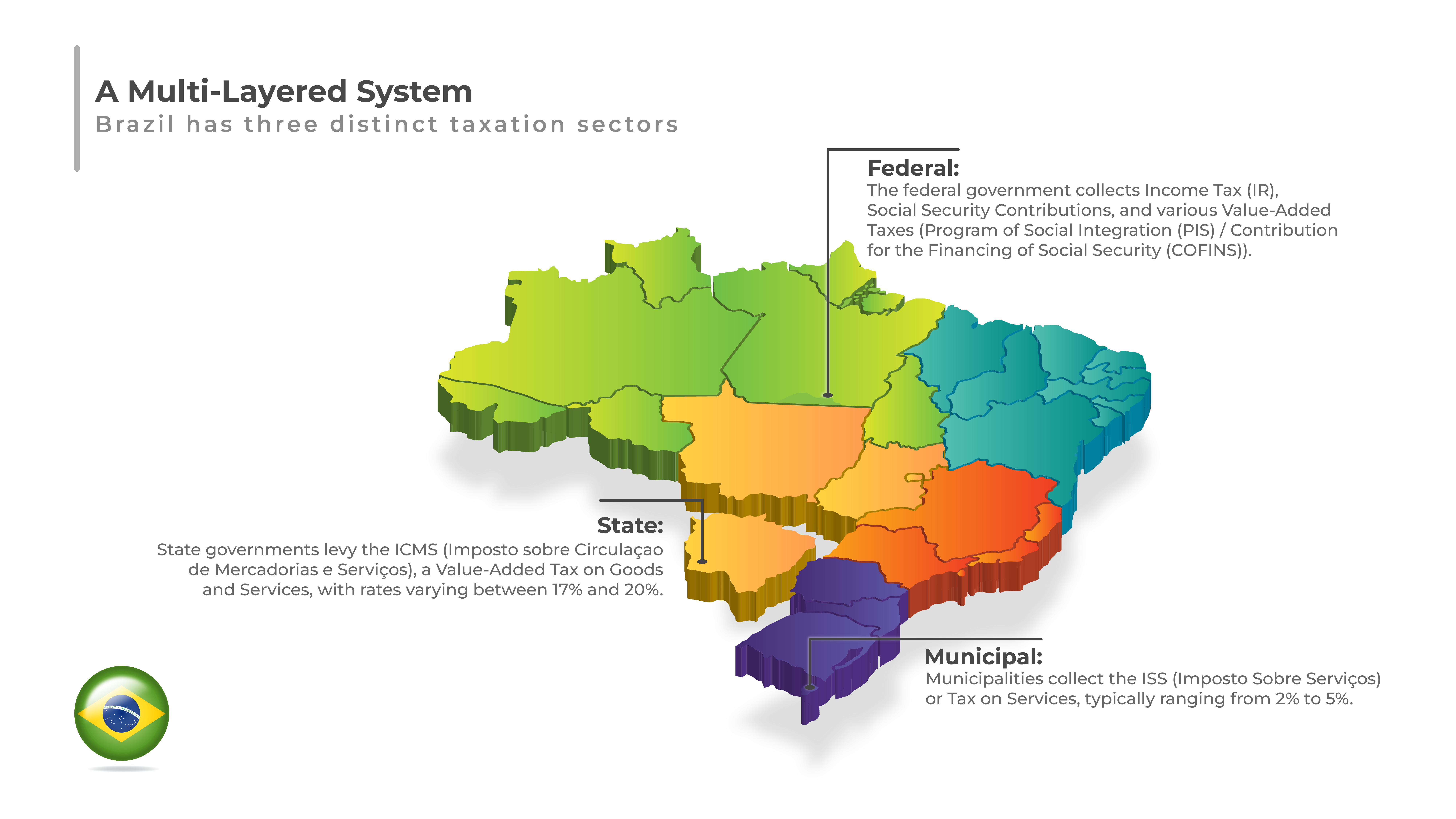

Brazil’s taxation regime is well known for its complexity, with numerous taxes levied at federal, state, and municipal levels. This intricate system can be a burden for businesses and individuals alike. This article provides an overview of the key features of the Brazilian tax system, including its structure, tax types, and recent reform efforts.

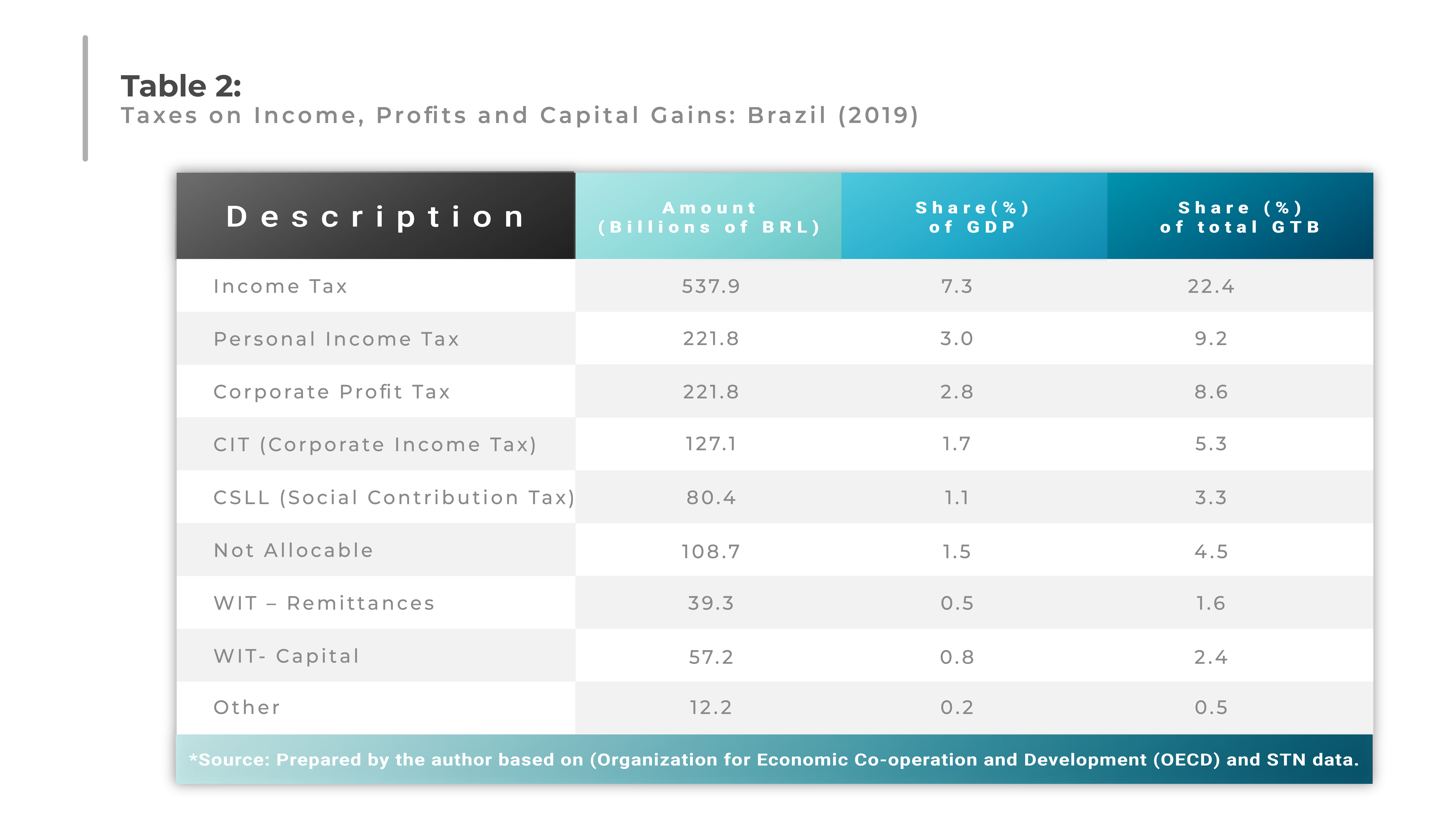

Tax system assessment, or the collection of laws governing how different public agencies use their taxing authority in relation to the taxes collected in a particular nation, is a well-known source of controversy. In Brazil, debate stems from the fact that the Federal Constitution of 1988 states that the Gross Tax Burden (GTB) expanded dramatically, going from 23.4% of GDP in 1988 to 33.5% of GDP in 2005).

The efficiency and equity of the tax system suffered during this time as a result of the growing burden, which was mostly the result of revenue pragmatism and short-term fiscal adjustment episodes that prioritized short-term fixes over quality concerns. Since then, GTB’s ascent has come to a stop. Over a fifteen-year period, it has ranged from an average of 32.6% of GDP to 31.6% of GDP in 2020, according to the most recent forecasts. The quality of Brazilian taxes has continued to deteriorate despite this period of stability because of an abundance of tax incentives, improperly calibrated special regimes, and a lack of substantial and inconsistent progress on the reform agenda.

Types of Taxes

Income Tax

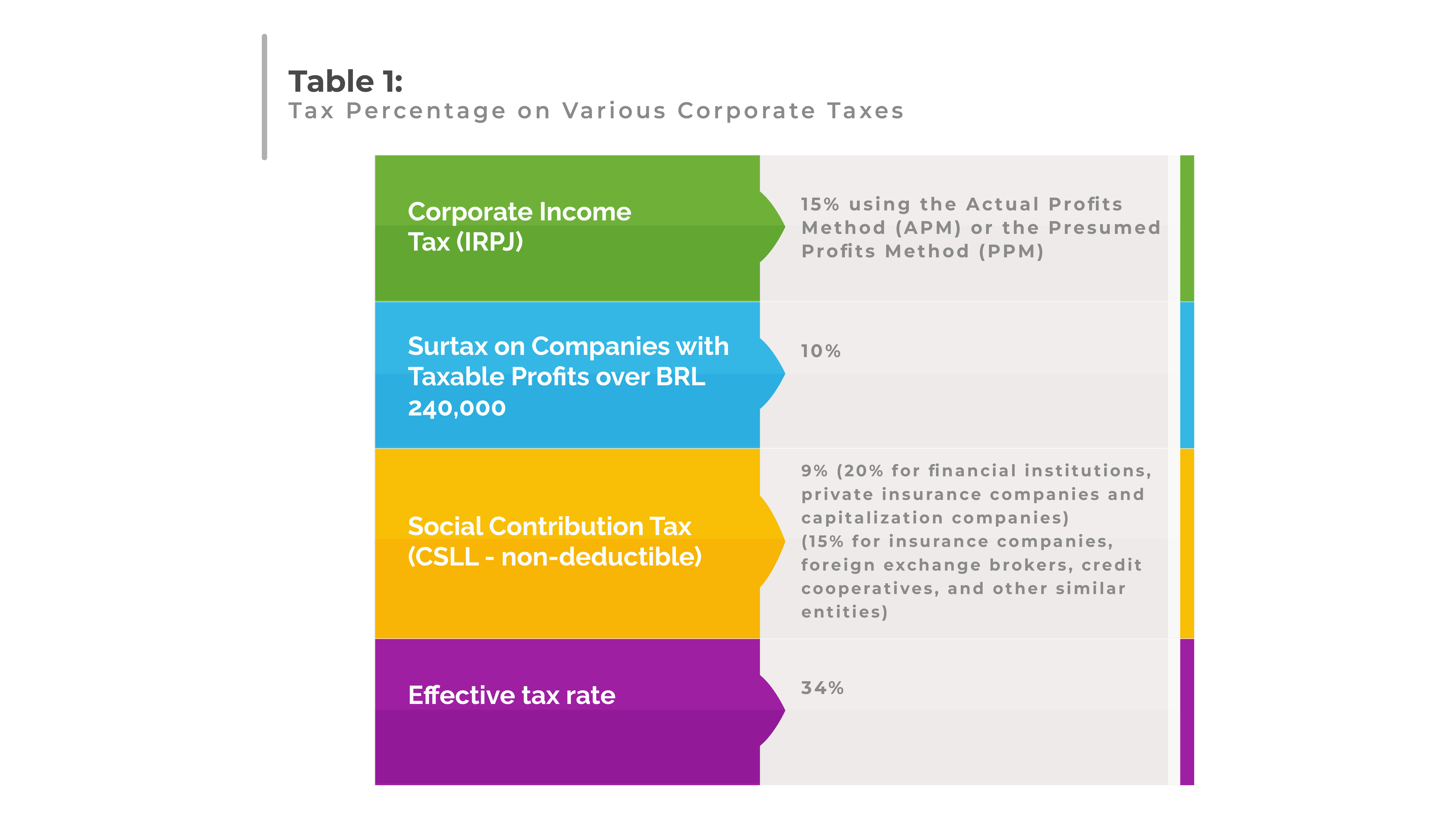

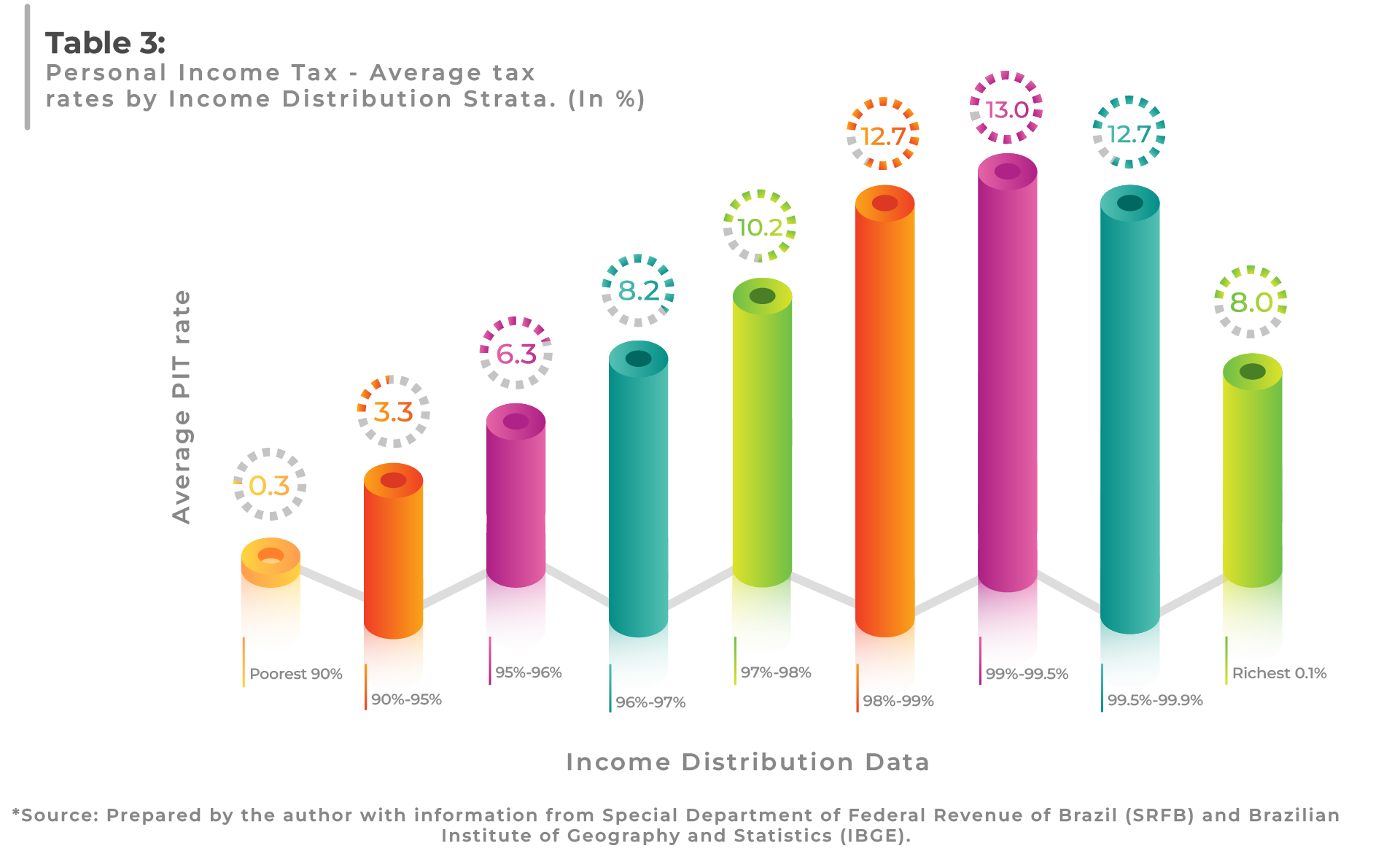

Resident individuals are taxed on their worldwide income, while non-residents are taxed only on Brazilian-sourced income. Rates are progressive, ranging from 15% to 22.5%.

Social Security Contributions

Both employers and employees contribute a portion of their salaries towards social security, with rates ranging from 7.5% to 14% for employees.

Value-Added Taxes (VAT)

Brazil has a complex VAT system, with the federal government collecting PIS/COFINS (combined rate of 3.65% or 9.25%) and states levying the ICMS (17% to 20%).

Municipal Service Tax (ISS)

Municipalities collect a tax on services rendered within their jurisdiction, with rates between 2% and 5%.

Tax Base for Resident and Foreign Companies

A company is considered a resident of Brazil if it is incorporated there and its head office serves as its tax domicile. “Taxable presence” (as opposed to the more popular “permanent establishment”) is a concept used by the Brazilian legal system to classify a non-resident company as a resident if it conducts business in Brazil through a fixed place of business or an agent who has the authority to enter into contracts in Brazil on the non-resident company’s behalf.

Tax For Foreign Companies

Companies with headquarters in Brazil must pay taxes on their global revenue. In general, non-resident businesses that have income originating from Brazil are subject to taxation in Brazil through a registered subsidiary, branch, or permanent establishment. On income sourced from Brazil, non-resident corporations could also be liable to withholding tax (IRRF).

Capital Gains Taxation

The treatment of capital gains is the same as that of regular income, with some exceptions regarding the limitations on the offsetting of capital losses against regular earnings.

A non-resident’s capital gains on an investment that is registered with the central bank are liable to progressive rates, which are as follows:

- 15% up to BRL 5 million

- 17.5% between BRL 5 million and BRL 10 million

- 20% between BRL 10 million and BRL 30 million and

- 22.5% above BRL 30 million

- If a resident of a tax haven derives the gains, a 25% rate is applicable.

Other Corporate Taxes

Various other taxes are levied in Brazil, which are as follow:

- Municipal Property Tax (IPTU): This is levied on annual basis which is based on the fair market value of property in urban areas and rates are determined by the property’s location and the municipality.

- Municipal Property Tax (IPTU): This is levied on annual basis on the fair market value of property in urban areas and rates are determined by the property’s location and the municipality.

- Municipal property transfer tax (ITBI): Levied on the transfer of immovable property, with rates varying according to the municipality where the property is located

- Tax on Financial Operations (IOF): This is levied on certain financial operations i.e., loans, foreign exchange operations, insurance, and securities, as well as operations with gold (as a financial asset) and foreign exchange instruments. The applicable rate will vary depending on the operation, with the general rate set at 0.38% (for cross-border loans of less than six months, the rate is 6% of the principal amount)

- Social Integration Program (PIS) tax: This is federal social contribution which is calculated as a percentage of revenue, and is levied at the rate of 1.65% (This may be reduced under certain circumstances)

- Social Security Financing Contribution (COFINS): A monthly federal social assistance contribution calculated as a percentage of revenue, is levied at the rate of 7.6%

- Import Tax: Rates generally vary between 10% and 20% (the maximum being 35%)

- PIS and COFINS on imports: These are levied at the rate of 1.65% and 7.6% on the import of services, respectively and 2.1% and 9.65%, respectively, on the importation of goods

- Municipal Service Tax (ISS): Imposed on a cumulative basis (it is not creditable), and the rates may vary between 2% and 5%, depending on the type of service (rates to be stipulated on a municipal basis)

- Social Security Contribution (INSS): Generally levied at a rate of 20% over the employees’ payroll (certain entities may be eligible to calculate INSS at a range of 1% to 4.5%, applied on the company’s gross revenue rather than being calculated upon the company’s payroll)

- Severance Pay Indemnity Fund (FGTS): This is levied on an employee’s salary at the rate of 8%

- Contribution for Intervention in the Economic Domain (CIDE): This is levied at the rate of 10% on remittances made by corporate taxpayers for royalties, administrative and technical services provided by non-residents.

Imports and Exports

There are certain kind of taxes imposed on Imports and exports. Import of goods is subject to ICMS, IPI, PIS/COFINS paid upon customs clearance and services are subject to a complex taxation that can reach more than 40% of the price paid abroad and is comprised of a withholding income tax at 15% to 25%, a special contribution (CIDE) at 10%, PIS/COFINS at 9.25%, ISSQN from 2% to 5%, and a financial transactions tax on the foreign exchange transaction (IOF/Câmbio) at 0.38%.

Naturally, there are significant disagreements over how to compute and pay these taxes. Exports on the one hand benefit from exemption of indirect taxation (no ICMS, IPI, PIS/COFINS due on export of goods and services from Brazil, which on the other hand requires a plan to receive tax reimbursements for the tax credits).as

Accounting System

Brazil adopted the IASB’s (International Accounting Standards) on a gradual basis between 2008 and 2010. As a result, Brazilian accounting procedures have undergone a number of significant modifications, the most significant of which is that these new accounting methods are necessary not just in consolidated financial statements but also in the individual financial statements (Law 11638/07). These include the recognition of leasing transactions, depreciation treatment, the recognition of intangible assets, impairment concept etc.

Accounting Practices

- The tax year runs from January 1 to December 31.

- Accounting Reports: A balance sheet, a profit and loss statement, a statement of cash flows, and notes to the financial statements are the minimum requirements for financial statements.

- Requirements for Publications: Every year, commercial businesses must publish a balance statement, a profit and loss account, and all the data needed to assess their financial standing.

Tax Reform Discussions

The Brazilian government has been actively discussing tax reform for several years. The primary goals include:

- Simplifying the tax code

- Reducing the overall tax burden

- Increasing tax efficiency

Proposed changes include streamlining the VAT system, implementing a withholding tax on dividends, and potentially lowering corporate income tax rates.

Conclusion

Brazil’s taxation regime presents a complex and challenging landscape for businesses and individuals. While reform efforts are underway, navigating the system remains a significant hurdle. Understanding the various tax types and their respective levels is crucial for anyone operating within the Brazilian economy.

Disclaimer

The information provided in this article is intended for general informational purposes only and should not be construed as legal advice. The content of this article is not intended to create and receipt of it does not constitute any relationship. Readers should not act upon this information without seeking professional legal counsel.